Author:

Jason dePreaux, Associate Director, IMS Research, IHS

Date

11/19/2012

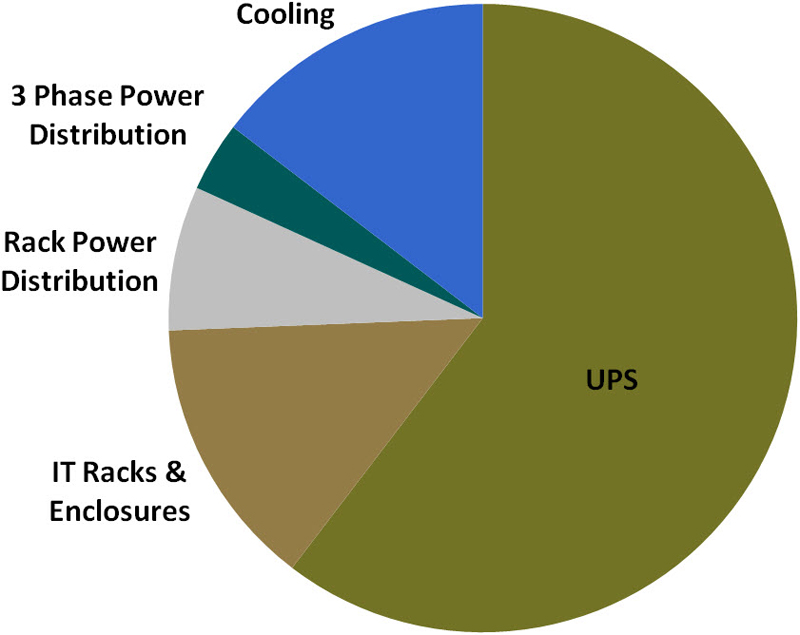

In a recent report, Data Center Infrastructure Yearbook, IMS Research forecast that the market for power and cooling products supporting data centers will grow to more than $15 billion by 2014. Power back-up and distribution equipment will comprise over 2/3 of this figure. Fastest growth is forecast for products that improve data-center efficiency. For example, the need to monitor electricity use is reshaping the power-distribution market with intelligent hardware, which commands higher prices than do their dumb counterparts. Cooling equipment is changing to cope with high-density computing environments. Even enclosures are evolving to facilitate increased airflow and power cabling. In power, one of the biggest shifts is in rack-level power distribution. Traditionally an afterthought, the trend has been to bring monitoring and switching to these products. PUE (power-usage effectiveness) is becoming a ubiquitous, if not somewhat flawed, metric to compare total data-center power use to server power. Deploying intelligent rack PDU help data-center managers get a better handle on their PUEand what they can do to lower it.

Single-phase units make up more than half of the UPS market. At the large end, static UPS modules are creeping up above 1 MVA to satisfy growing power demands. Transformerless UPSs using IGBTs now account for more revenues than SCR-based units do. These new UPSs offer better efficiency, especially under partial load, where UPSs spend most of their lives. Future growth in the data-center-infrastructure market will be a balance between opposing forces (figure 1): Digitization continues unabated. Mobile data, electronic health records, and internet connectivity drive data-processing and storage needs, demanding more data centers. However, new servers offer greater efficiency, which reduces the need for additional infrastructure. Today, economic conditions often serve as tiebreaker. The cloudy economic picture dampens companies' willingness to spend on capital-intensive projects like data centers. Still, big multinationals are expanding their reach into data-center products and services. Over the past five years, three vendors have consolidated their positions by acquisition. Schneider Electric, Emerson, and Eaton combined to hold 47% of the 2011 data-center-infrastructure market. These big three have each made multiple acquisitions to enhance product portfolios and extend geographic reach. Beyond this are hundreds of vendors with smaller niches around the world. IMS Resreach