Author:

David Morrison, Editor, How2Power

Date

08/24/2012

Though electric vehicles (EVs) and hybrid electric vehicles (HEVs) only account for a modest percentage of overall car sales, the sales of these more-electric vehicles are on the rise. According to a forecast by Pike Research, annual sales of EVs and HEVs will reach 2.9 million vehicles by 2017.[1] Meanwhile, vehicle electrification is also taking root in the commercial and industrial markets. For example, another firm, IDTechEx, predicts that sales of heavy industrial vehicles like cranes and forklifts will grow nearly 70% over the next five years, reaching 763,000 vehicles in 2017 (Table 1.)[2] These growing EV and HEV markets have been creating numerous design challenges and career opportunities for power electronics (PE) engineers, as documented in prior articles.[3,4,5,6] But one issue that may have received little attention previously is how these design challenges and opportunities are cropping up in various segments of the automotive industry and at different points in the supply chain. A recent survey of automotive industry websites reveals job opportunities in several types of companies. You can view a listing of these job openings in the online version of this article. As might be expected, there are opportunities for PE engineers at the larger, more-established automotive companies such as Ford and the tier 1 suppliers such as Delphi and Continental. But there are also a number of opportunities for PE engineers at EV specialist companies such as Tesla Motors, VIA Motors, and GreenTech Automotive. Similarly, there are companies specializing in electric power train and propulsion technology such as Mission Motors and AC Propulsion that seek experienced PE engineers. But there's also another dynamic segment of this industry that needs power electronics expertiseâ€"the battery companies who are developing the advanced cells, packs, and systems that will be critical to the success of new EV and HEV designs. These companies need EEs with various PE skills to address battery management issues and develop related hardware. The list of these companies currently seeking EEs includes the likes of Dow Kokam, Sion Power, Valence Technology, and Johnson Controls. Regardless of where engineers are in the automotive supply chain, there is an imperative to develop solutions at the lowest possible cost. This goal takes on even greater significance in the development of EVs and HEVs, since the industry is trying to reduce the price premium associated with these vehicles. Naturally, this issue impacts the design of all the power electronics functions.

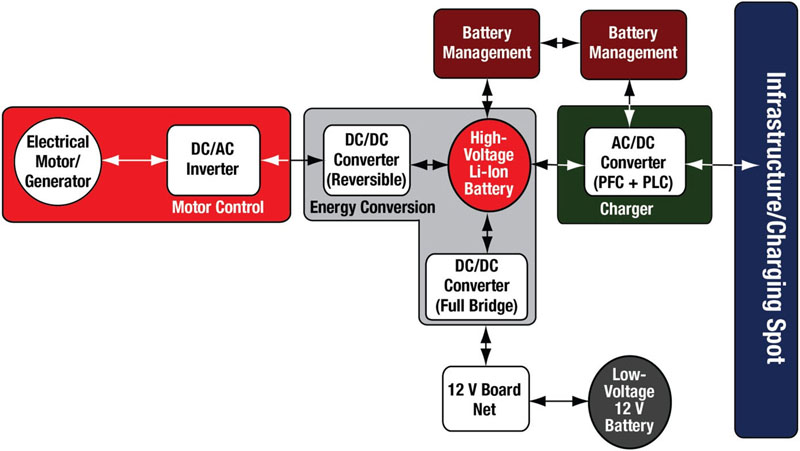

Gary Cameron, currently Directorâ€"Advanced Electronic Controls Engineering at Delphi, has pointed out that the techniques for managing power in electric and hybrid-electric vehicles are understood, but the cost of implementing the various power conversion and power management functions needs to be driven down. "The big challenge is doing them at an affordable cost. If you're going to convert a large percentage of the vehicles produced into electric drive power trains, you've got to get the cost closer to parity with the alternatives. They continue to make improvements in internal combustion engines, diesel, gas, etc. but they're still going to need electrification. The overall car can't be too expensive for the public to buy," says Cameron. Figure. 1 shows the block diagram of an example power system architecture in a hybrid electric vehicle,[7] identifying the key power functions that PE engineers are working to develop with low-cost and other performance goals in mind.

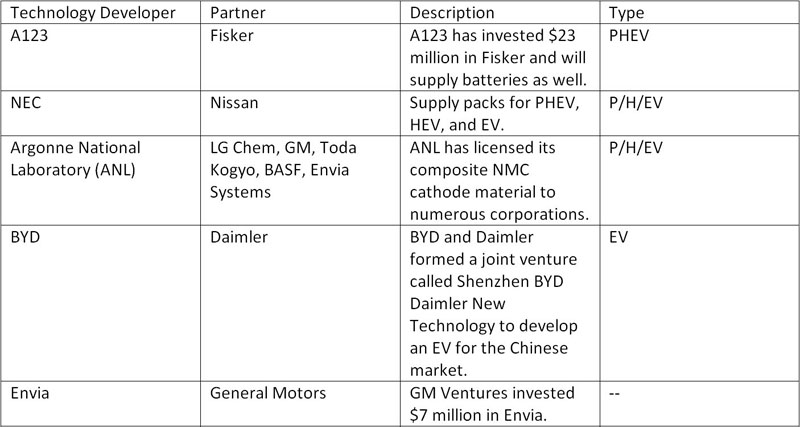

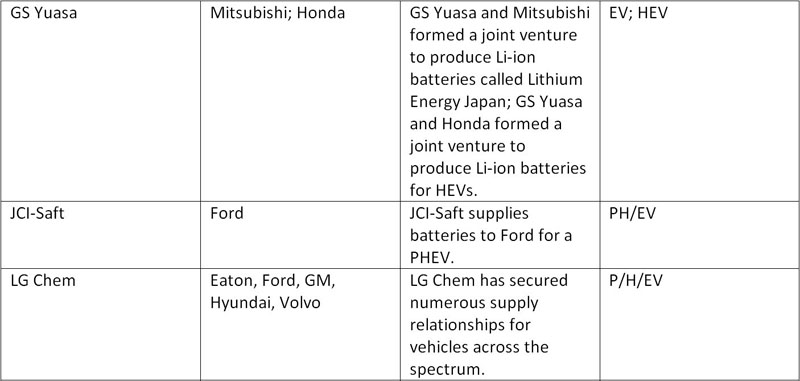

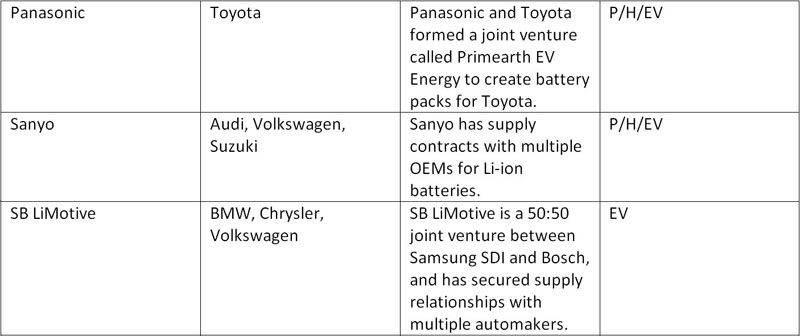

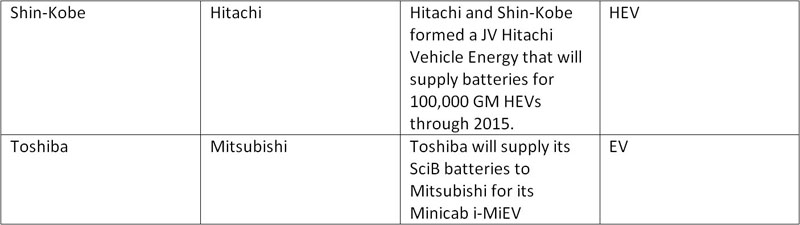

In this diagram, the main traction battery is depicted in red, looking like the very heart of the system that it is. Perhaps, then, it is not surprising the amount of industry attention that is now focused on advanced battery development, which is evidenced by the numerous partnerships between automakers and battery developers. The chart in Table 2, provided by Lux Research,[8] highlights the various industry alliances to develop better, more-economical batteries for electric vehicles and hybrids. These alliances also suggest potential sources of employment, now or in the future, for PE engineers looking to play a role in putting more EVs and HEVs on the road.

References: 1. "Electric Vehicle Market Forecasts; Global Forecasts for Light-Duty Hybrid, Plug-in Hybrid,and Battery Electric Vehicles: 2011-2017," Pike Research, www.pikeresearch.com/research/electric-vehicle-market-forecasts. 2. IDTechEx, http://www.idtechex.com/. Also see the announcement regarding their EV market report, "Industrial, Commercial Electric Vehicle Markets to Grow 420% by 2022 as Fossil Fuels Crisis Accelerates," Global Information Inc., April 18, 2012, www.giiresearch.com/press/5288.shtml. 3. Hybrid Vehicles Drive New Demands for Power Electronics Expertise, by David G. Morrison, How2Power Today, Power Supply Jobs & Technology section, January 2010, www.how2power.com/newsletters/1001/jobs/H2PToday1001_jobs.pdf. 4. Power Electronics Engineers Move EVs And Hybrids Forward With Cost-Cutting Innovations, by David G. Morrison, How2Power Today, Power Supply Jobs & Technology section, August 2011. 5. "Rugged Vehicle Applications Drive Search For Seasoned Engineers in Heavy Equipment Industry," by David G. Morrison, Power Systems Design magazine, August 1, 2010, 6. "EV Charging Stations: A New Outlet for Power Designers," by David G. Morrison, Power Systems Design magazine, August 16, 2011. 7. Texas Instruments' "Hybrid and Electric Vehicle Solutions Guide," published second quarter 2011, www.ti.com/hev. 8. Lux Research, www.luxresearchinc.com/. About the Author When he's not writing this career development column, David G. Morrison is busy building an exotic power electronics portal called How2Power.com. Do not visit this website if you're looking for the same old, same old. Do come here if you enjoy discovering free technical resources that may help you develop power systems, components, or tools. Also, do not visit How2Power.com if you fancy annoying pop-up ads or having to register to view all the good material. How2Power.com was designed with the engineer's convenience in mind, so it does not offer such features. For a quick musical tour of the website and its monthly newsletter, watch the videos at: www.how2power.com www.how2power.com/newsletters